Insuring Your Most Valuable Asset…You!

If an accident or illness were to prevent you from working, would you be able to support yourself for six months, one year, or possibly longer?

Your paycheck is probably your most valuable asset. Protecting it is one of the smartest financial decisions you can make. The statistics alone illustrate the need for this essential protection:

- According to the Social Security Administration, one in four of today’s 20-year-olds will be out of work for a year or more before they retire.1

- The 2019 American Payroll Association Survey reports that 68% of Americans live paycheck to paycheck and would find it difficult to meet their financial obligations if their paychecks were delayed for even a week.2

The bills don’t stop just because you can’t work.

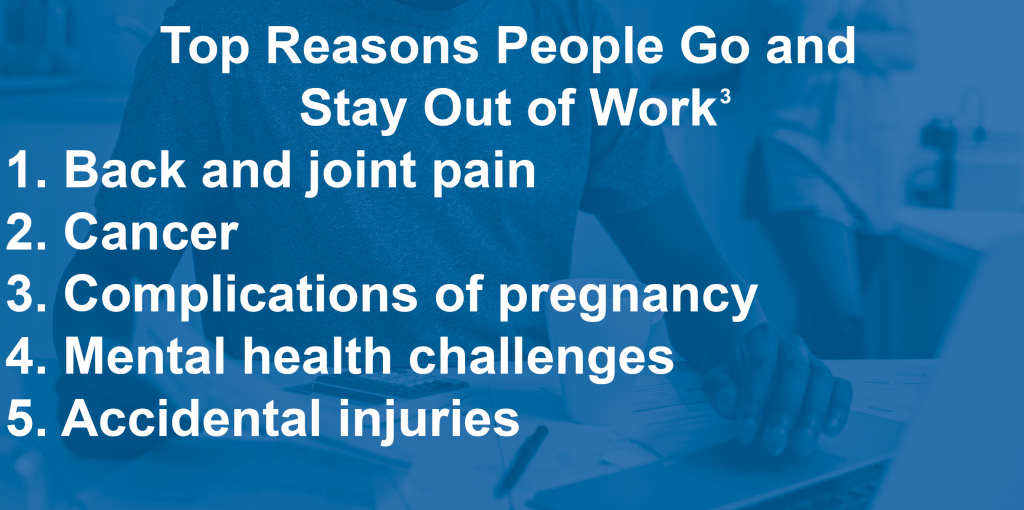

A health issue can lead not only to medical bills, but also to extended time away from work – perhaps even years of treatment and rehabilitation. Long Term Disability (LTD) insurance protects your income if you need to miss work to recover from everything from back pain, to a broken leg, to cancer. LTD insurance is one of the most critical forms of coverage for working Americans—and one of the most overlooked.

If you or others are dependent on your ability to earn, then it’s worth considering – from early in your career through retirement.

Alum LTD Provides:

– 15% discount for alums and family members

– Special plans and benefit packages from an A-rated industry leader

– Expert advice

LTD benefits can help with:

- Income replacement. Coverage to help meet day-to-day expenses so you don’t need to access other financial resources.

- Student loan protection. For recent graduates living on starting salaries, student loan payments often comprise a significant portion of monthly expenditures, making a possible disability especially risky. An LTD policy with a student loan rider provides some extra protection.

- Retirement savings preservation. Emergency savings only goes so far. Disability income benefits can prevent you from having to tap into your hard-earned savings prematurely.

If you haven’t insured your income, contact us today to discuss the Alum LTD program. Our licensed professionals can help you design a policy that fits your needs both today and down the road.

1 The Faces and Facts of Disability, Social Security Administration, 2018.

2 “Getting Paid In America,” American Payroll Association, 2019.

3 Council for Disability Awareness, 2018.